Blockchain is becoming a hot topic in the business world so we’re going to continue to talk about its potential business applications, especially in how it can revolutionize the global supply chain. As we noted in our recent blog post, the subject is a complicated one that mixes a lot of theory with some practicality, which is common when there is a potential for such a large economic shift. To this end, I highly recommend you read our first post on the subject before continuing as it will help put the information below into context.

Some History

First, let’s start with some history: Back in 1933 the US decided to stop using the gold standard to back its currency in the Great Depression. Prior to 1933, there was no way to add new currency to the US economy unless the United States acquired more gold (a finite resource to say the least). After 1933, the value of the dollar was not linked to any particular asset and the federal government can print money or remove it from circulation as it pleases. But the economic impacts of those actions are still heavily debated. A global shift to cryptocurrencies and Blockchain technology is like removing the gold standard, and in terms of maturity, it’s like its 1935 and we are still trying to figure this stuff out. Now though, instead of removing the gold backing, cryptocurrencies are removing governments, banks, and all institutions in between.

The Value of This Shift

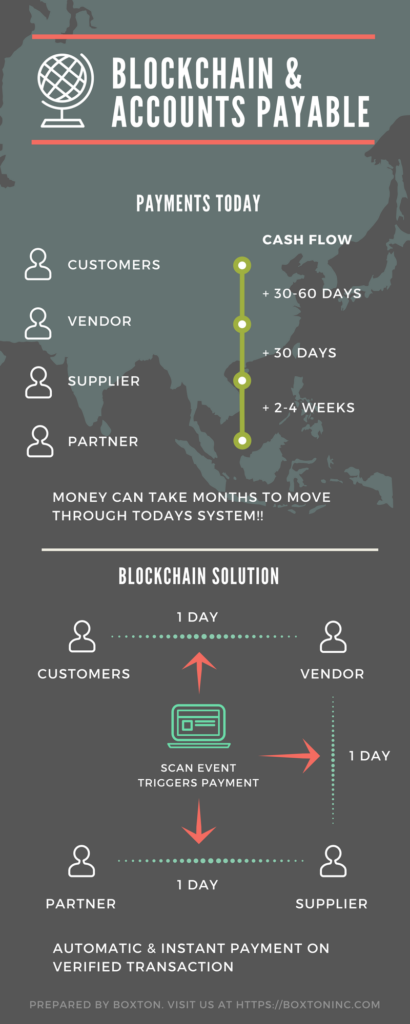

The value of making a new shift of this magnitude is that it could start to revolutionize a fundamental piece of how the economy functions: payment of settlement. For example, our company Boxton, like most companies out there, spends a huge amount of time managing cash flow, and specifically, making sure we get paid on time. And the more time you spend on it, the more the entire problem seems absolutely absurd! Why all of this negotiation on getting paid in 15, 30, 45, or 60 days? Why have the constant worry about not getting paid for a service you’ve completed? After all, within every transaction there is an entire chain of people getting paid:

Our customer gets paid for selling a good, pays us for shipping it, we pay a freight forwarder, they pay a trucking company, who pays a trucker, who buys a good our customer is selling. But there is so much financial loss in the delays in payment between each entity that adds ZERO economic or social value!

There is value in building a speaker that goes into an iPhone that plays music that someone will pay to enjoy. There is no value in the interest paid or the opportunity costs lost between getting paid in 45 days by your customers but having to pay your vendors in 30 (and yes, I know this makes our financial friends queasy, but bear with my simplification to allow my point to sync in).

So What Does This All Mean?

But Joe, I thought this was Part II of your blog about Blockchain, get to the point! The point is that Blockchain tech can bridge this gap. The point of Blockchain is that it builds trust into the system through managing shared data as well as triggers events across the entire network based on specific causes. Blockchain is now using something called “smart contracts” in which you can set up a transaction where party A pays party B as soon as something occurs. For example, as soon as the receiver of a shipment signs for a package the Blockchain can execute payment from a customer to a business. Or better yet, as soon as the receiver of a shipment signs for a package, the Blockchain can execute payment across the ENTIRE transaction. The receiver can pay my customer, the customer can pay us, we can pay the freight forwarder, and the freight forwarder can pay the trucking company who pays the truck automatically every week. And furthermore, if we were all using a cryptocurrency (such as bitcoin), these payments could happen instantaneously, without needing a bank to act as an intermediary.

The benefits to this are huge! You get to work with people only with a good history of payment (think of it has a business credit score) because every transaction is recorded. You are assured of payment and you can eliminate EVERYONE’s need to borrow money to pay their vendors while waiting for payment from their customer. All of this makes goods cheaper to buy as part of almost every product’s margin is the cost of financing related to lack of payment assurance. The implications of Blockchain and cryptocurrency technologies are boundless, but B2B payment settlement will be one of the first frontiers touched by these innovations.

Click Here for downloadable PDF